Wages On-Demand for Your Business: Quick Serve Restaurants

Chaz Somers

Chaz Somers

Chaz Somers started his professional career as a part-time social media contractor at ZayZoon and since then, has evolved into a full-time content marketing associate. Chaz’s love for branding and storytelling has led him to blog writing, clothing design and video production all within ZayZoon.

Quick Serve Restaurants are a part of a $200 billion+ industry that is constantly growing, however, many companies struggle with employee retention and turnover. Some companies even reporting turnover rates as high as 130% over the course of a year.

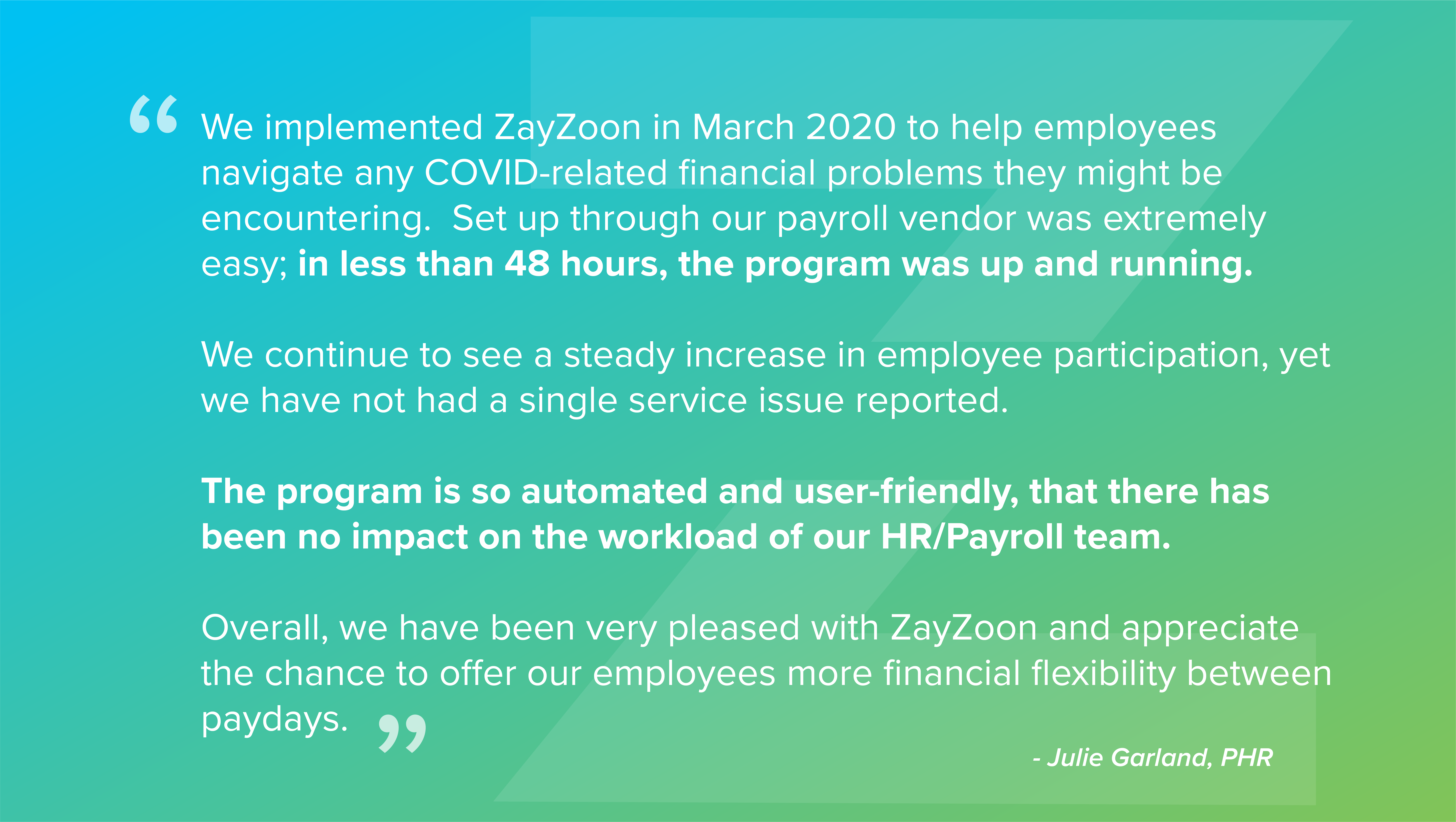

Julie Garland is a part of SERJ Group, a franchisor of Sonic's and Taco Bell's throughout California and Washington. Quick Serve Restaurants like Sonic or Taco Bell are extremely common throughout the United States and not only provide customers with quality meals and prices but also provide fulfilling jobs to members of their community. We sat down with her to learn how ZayZoon has helped her business.

QSR workers are familiar with high-intensity situations, long hours, and sometimes even dirty work, yet they're not always compensated properly. Many of these workers live paycheck to paycheck, making saving money an extra difficult task. This lack of savings means employees without some type of extra support system can find themselves in extremely volatile financial situations.

When these financial uncertainties do inevitably arise, these workers find themselves in difficult situations where they may need to either borrow money from a friend or family member, or in even worse scenarios, a payday lender.

Nobody looks forward to asking someone else for money but for some people when times get tough it's the only way to avoid slipping into a debt spiral where late fees and overdraft charges can further overwhelm someone already down on their luck.

Spiralling into debt is common and has been for some time now. Of course, employers would never willingly let their employees endure so much stress and debt but for small and medium sized business the fact of the matter is, theres not much in their power that they can do. A problem Julie from SERJ Group knew needed to be solved.

With traditional payroll, employees are often paid either in bi-weekly or semi-monthly instalments, sometimes having to wait even longer. Unfortunately, these instalments don't always align with the real life expenses these hardworking employees face every month. In a perfect world, employees would be paid whenever they need their money, however, not only would paying your employees daily be a logistical nightmare but it would also end up costing an unsustainable amount of money to the company.

So how does a company actually combat this problem? For a very long time, there was no viable solution and this was a harsh reality for many but fortunately, as technology has progressed, now there is a solution.

With ZayZoon's Earned Wage Access offering, employees can access a portion of their paycheck, whenever, wherever they want and for only a small fee per transaction. This accessibility makes avoiding unnecessary fees and uncomfortable conversations much easier for employees, improving morale and productivity in the workplace. Most importantly it helps your employees avoid predatory loans and vicious debt spirals that could take months, or even years to overcome.

See what Julie from SERJ had to say about ZayZoon and Wages On-Demand below:

Offering a product that is simple to use and easy to navigate has always been a top priority for ZayZoon. We provide employees with a simple-to-use interface and access to many tools, including Earned Wage Access, to help them achieve Financial Wellness.

ZayZoon's commitment to a user-friendly product doesn't end there. Companies are amazed at how easy setting up and managing the service is. ZayZoon never disrupts payroll and never interferes with HR, saving your team time and energy that can be better spent elsewhere.

Unlike other Earned Wage Access providers, ZayZoon doesn't require any pre-funding from the business, theres no need for manual reconciliation, and ZayZoon does not require any type of payroll card. The focus has always been on technology and perfecting the process to be the best financial health add on possible for small and medium-sized businesses.

We know that small and medium-sized businesses can't stomach a heavy implementation or added administrative tasks, so we made sure to make our solution 100% automated and 100% seamless.

To learn more about offering ZayZoon and it's plethora of Financial Wellness Tools, including Wages On-Demand, go to: